Preliminary Class 8 truck orders were up over historical averages in May, FTR and ACT Research announced Tuesday.

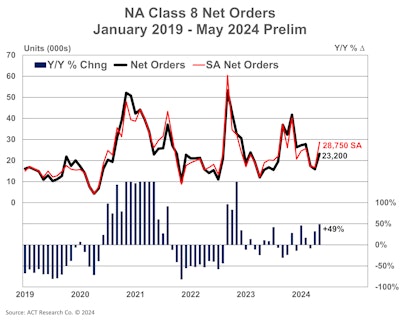

FTR pegged last month at 18,900 units; ACT was much more bullish at 23,200 units. FTR says the month was up 37% year over year and 2% above May's 10-year average. ACT's total was up 46% month over month and 49% year over year. FTR adds Class 8 orders for the past 12 months totaled 273,900 units.

Both firms state May's strong preliminary totals indicate industry fears of a rapid demand decline into the summer are unlikely. FTR states the market is performing moderately above replacement level for orders. After maintaining an average level of around 20,700 units over the previous three months, FTR says orders have continued to slow at a seasonally typical rate, averaging 17,900 units in the last three months.

“Market observers may recall that demand typically slows in Q2. However, surprises are always lurking. Class 8 preliminary order intake provided May’s drama, effectively zigging when they were expected to zag,” says Steve Tam, ACT vice president and analyst.

[RELATED: Peterbilt announces CARB-compliant diesel engine]

“OEMs are actively filling build slots at a steady pace. Along with the month-over-month increase, the fact that orders were up significantly from the May 2023 level indicates that the market remains on a solid footing despite near-term challenges,” adds Dan Moyer, FTR senior analyst, commercial vehicles.

Tam says future market conditions may have impacted May's strong results.

“Ample open build slots in Q3 and Q4, combined with the OEMs’ desire to achieve some semblance of balance with respect to the impending pre-buy likely impacted May’s order activity,” he says. “While we do not have complete visibility at this point, the strength is presumably driven by private and vocational fleets, supplemented by an ongoing healthy appetite for equipment in Mexico.”

Moyer also pointed to the vocational market as an area of large growth.

“While all OEMs experienced order growth, vocational markets stood out as particularly strong compared to on-highway. Despite the trend of stagnant freight markets, fleets remain willing to invest in new equipment. Order levels slightly exceeded historical averages and seasonal expectations, and we still anticipate a replacement level of output by the end of 2024.”

In the medium-duty space, Tam says orders were “a picture of stability,” with Classes 5-7 net orders at 18,900 units, up 0.2% from April but down nearly 7% from 2023.